Starting a SaaS (Software as a Service) business can be a lucrative endeavor, but success is not guaranteed. Certain types of SaaS businesses may pose higher risks or face more challenges than others. Here are some types of SaaS businesses that could be considered more challenging or less favorable to start, based on market saturation, high competition, significant regulatory hurdles, or a limited customer base:

Do all your scenario planning with these SaaS financial models.

Highly Competitive Markets Without a Unique Value Proposition: Entering a market with established players without offering a clear, unique value proposition can be extremely difficult. For example, project management and email marketing tools are highly saturated markets where new entrants might struggle without a distinct differentiation.

Niche Markets with Limited Growth Potential: While targeting a niche market can be a good strategy, it's important to ensure that the niche is not too small or too limited in growth potential. A SaaS business that serves a very specific need for a very small audience may have difficulty scaling.

Regulated Industries Without Proper Compliance: SaaS businesses that deal with highly regulated data, such as healthcare (HIPAA compliance) or finance (PCI DSS compliance), can face significant barriers to entry and high costs associated with maintaining compliance. Lending-as-a-Service is one that comes to mind.

Copycat SaaS Products: Simply replicating an existing successful SaaS product without significant improvements or innovation is likely to fail. Customers need compelling reasons to switch from a product they already use to a new, untested option. Think Kick vs Twitch. If you are breaking into a market with heavily established competitors, you had better have some extremely compelling changes that make your platform significantly better.

Products That Require Significant Customer Education: If your SaaS product solves a problem that customers don't know they have, or if it requires significant effort to educate the market on the value of your solution, it can be challenging to achieve traction. Difficulty to spread word-of-mouth is a very bad thing.

Products with High Customer Acquisition Costs: If the cost to acquire a customer (CAC) is significantly higher than the lifetime value (LTV) of that customer, the business model may not be sustainable. This is often a risk with SaaS businesses that target very specific, hard-to-reach audiences. This SaaS Ad Spend Guide is a good tool to measure these things. Also, tracking LTV and retention is good to understand if you are going to scale. This SaaS customer cohort template is good to analyze your historical customer data.

SaaS Products That Depend on Unreliable Third-Party Services: If your SaaS offering relies heavily on data or services from third parties that are unreliable or subject to change, your business could be at risk. This includes businesses that are overly dependent on APIs that can be deprecated or significantly altered.

It's important to conduct thorough market research, validate your business idea with potential customers, and consider how to differentiate your product in the market before starting a SaaS business. Being aware of these challenges can help you navigate the complexities of the SaaS landscape more effectively.

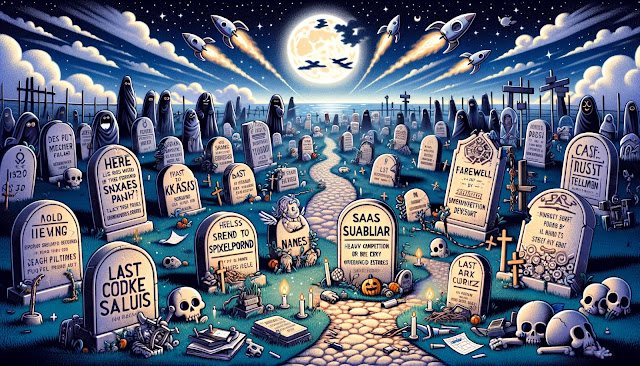

Real World Examples of Failed SaaS Businesses

Several SaaS businesses have failed over the years, often due to reasons like market saturation, lack of product-market fit, financial mismanagement, or failure to adapt to changing market demands. Here are a few real-world examples of SaaS businesses that failed, along with insights into what went wrong:

Quibi: Quibi was a short-form streaming platform that aimed to revolutionize how people consumed video content, specifically designed for mobile devices with high-quality, short episodes. Despite raising nearly $2 billion in funding, Quibi shut down just six months after its launch in 2020. Key factors in its failure included a lack of a clear product-market fit, the high competition from established streaming services, and launching during the COVID-19 pandemic when potential users were at home, not on-the-go, which was the app's primary use case.

Theranos: Although not a traditional SaaS business, Theranos's software platform was a significant part of its value proposition, promising to revolutionize blood testing with just a few drops from a finger prick. The company faced massive legal and operational challenges due to fraudulent claims about the capabilities of its technology, leading to its collapse. The lesson here revolves around the importance of transparency and the validation of product claims, especially in highly regulated industries.

Better Place: Focused on electric vehicles and the supporting infrastructure, Better Place offered a unique battery-swapping technology and management software for EVs. Despite raising substantial funding, it failed in 2013. The failure can be attributed to overestimating market readiness for its technology, high upfront infrastructure costs, and the logistical complexities of its battery-swapping stations, underscoring the risks of innovating ahead of market demand.

Webvan: An online grocery delivery service that, while not purely a SaaS, incorporated significant software elements in its business model. Webvan expanded too quickly, investing heavily in infrastructure without a proportional growth in customer base, leading to its bankruptcy in 2001. This case highlights the dangers of scaling too fast without achieving efficient operational and unit economics.

Color: Launched with a $41 million pre-launch funding, Color was a photo-sharing app that aimed to redefine social interaction by allowing users to share photos with people nearby. It failed to gain traction due to a cluttered user interface, lack of privacy controls, and a concept that was too ahead of its time or not clearly defined for the market. The failure of Color demonstrates the importance of user experience design and market timing.

Article found in SaaS.